Related topics

There are no related topics.

It’s easy to dream of quitting your day job to chase that side hustle or passion project you’ve dreamt of pursuing for years. But what if you don’t know what your passion is, exactly? Is it the life of a thrill-seeking explorer or high-flying exec? Are you a budding muso or driven to invest? If you need help figuring out what motivates you, here are five books that promise to help you think about where you want to go – in totally different ways.

A Job to Love, The School of Life

“What do you want to be when you grow up?” is a fun question to be asked as a child. But what if you’re already grown up and still aren’t sure what you want to do for a living for the rest of your life, fear not: A Job to Love offers a roadmap out of the uncertainty. The nice-looking hardback comes courtesy of The School of Life, the global organisation set up by Alain de Botton that uses philosophy to solve life’s most important yet everyday problems. Combining philosophical research with practical questionnaires and exercises, A Job to Love works from the assumption that we must first understand ourselves, our aspirations and our sometimes-confused desires before we can find a job that’s right for us.

Mindful Money, Canna Campbell

There’s a good reason why getting on top of your finances is such a common New Year’s resolution: who doesn’t want to pay off their debts, set aside a little nest egg and grow their personal wealth? But then life happens, and the resolution often gets postponed to next year. And the next. And then the next. Canna Campbell gets it: as a young mother and budding entrepreneur, she developed an approach to financial management that draws on the power of mindfulness as well as her training as a financial planner. Mindful Money is her book about this approach – a practical guide that outlines the rituals and habits she used to achieve financial independence, which then allowed her to focus on the things in life that she really values.

Wild, Cheryl Strayed

Cheryl Strayed was working a series of dead-end jobs when she decided, more or less on impulse, to pack up her things and hike more than 1,500 kilometres from the Mojave Desert up to Oregon, Portland. All this despite the fact that she had no hiking experience and could barely bear the weight of her stuffed-to-the-seams backpack. The experience was hard and harrowing – she lost her hiking boots, as well as most of her toenails, in the process – but she gained something completely, absolutely worthwhile: as she writes in Wild, her captivating and beautifully written memoir, the experience showed her a “way out of the woods”. The book lays bare life’s challenges – as well as the power we each have to overcome them and heal our wounds.

Shark Tales, Barbara Corcoran

At first glance, Barbara Corcoran’s Shark Tales might look like a standard business self-help book. (Its subtitle, How I Turned $1,000 into a Billion Dollar Business, definitely nudges things in that direction.) But while the book is full of great advice if you’re looking to start your own business, it’s also a bold memoir about hardship and perseverance. Corcoran is best known as one of the investors on the reality TV business show Shark Tank. But as she recounts in the book, her life began far away from the bright lights of show business (or the large venture capital cheques of the business world). If you’re looking for a rags-to-riches tale with heart and practical tips on forging your own path, Shark Tales is for you.

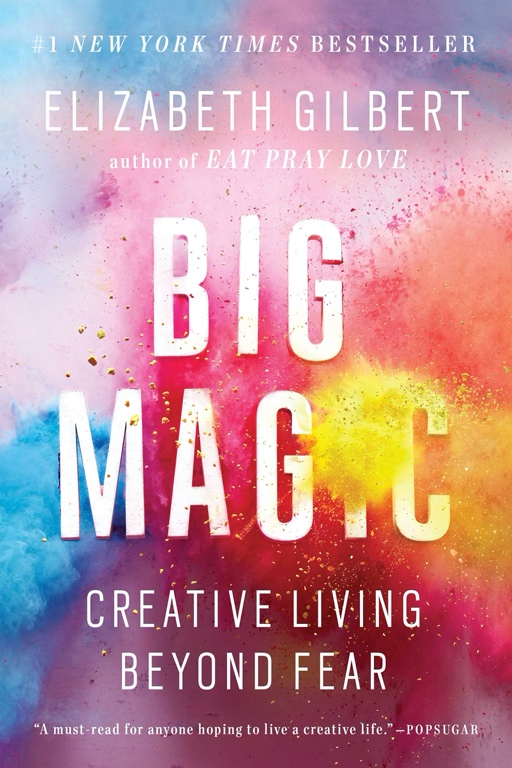

Big Magic, Elizabeth Gilbert

In Big Magic, author Elizabeth Gilbert sets out the attitudes, approaches and habits you need to live a creative life. Even if you don’t want to become a painter or pen the next great Australian novel, keep reading – because while Big Magic has advice for budding artists, it’s primarily concerned with helping people live “a life that is driven more strongly by curiosity than by fear”. In her signature writing style (you may know Gilbert for her 2006 book Eat, Pray, Love), the author outlines her insights on inspiration and tips for living a life as creatively as her own. There’s good stuff in here, no matter the path you’re travelling.

ING is not affiliated with the individuals and organisations mentioned above and does not endorse their product or service, nor accept any liability in relation to the statements made by them in this article.

The information is current as at publication. Any advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. Deposit products, savings products, credit card and home loan products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292, AFSL and Australian Credit Licence 229823. Living Super, a sub-plan of OneSuper ABN 43 905 581 638 is issued by Diversa Trustees Limited ABN 49 006 421 638, AFSL 235153 RSE L0000635. The insurance cover offered by Living Super is provided by Metlife Insurance Limited ABN 75 004 274 882, AFSL 238096. ING Insurance is issued by Auto & General Insurance Company Limited (AGIC) ABN 42 111 586 353 AFSL Licence No 285571 as insurer. It is distributed by Auto & General Services Pty Ltd (AGS) ABN 61 003 617 909 AFSL 241411 and by ING as an Authorised Representative AR 1247634 of AGS. All applications for credit are subject to ING's credit approval criteria, and fees and charges apply. You should consider the relevant Product Disclosure Statement, Terms and Conditions, Fees and Limits Schedule, Financial Services Guide, Key Facts Sheet and Credit Guide available at ing.com.au when deciding whether to acquire, or to continue to hold, a product. Before interacting with us via our social media platforms, please take a minute to familiarise yourself with our Social Media User Terms https://www.ing.com.au/pdf/Social_Media_User_Terms.pdf.