Related topics

There are no related topics.

There’s nothing worse than falling in love with a property only to be told by lenders that it’s about $250,000 beyond your budget. You. Still. Want. That. House. Getting an idea of how much you can afford to borrow up-front helps you avoid emotional house-hunting hiccups like these.

In the early stages of looking into home loans, you can easily get an estimate of your borrowing power from lenders (most have online tools). As you get to the pointy end of house-hunting, you can firm up that estimate with pre-approval.

So let’s take a look at all of this – plus other things to consider about how much you can afford to borrow – in more detail.

Get a ball park figure

In working out your borrowing power, lenders look at a little more than just your money coming in and going out. Things like the limit on your credit card, personal loans and whether you have kids will play a part.

You can enter all of this info into a borrowing power calculator, which crunches the numbers to give you an indication of how much you could borrow based on the information you provide about your current circumstances.

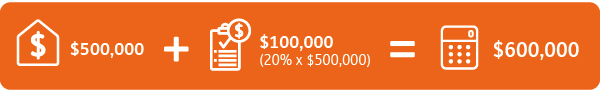

Say the number that the calculator spits out is $500,000. If you’re hoping to save a 20% deposit then you could do the following sum to get an idea of how much you could spend on a property:

It is also important to consider the costs that you’ll need to pay additional to the deposit, such as stamp duty, legal and conveyancing fees, removalists and building inspections etc.

Flesh out your budget

With an estimate of how much you could afford to borrow in mind, you could then play with your budget to see how home loan repayments fit into the picture (if you haven’t done a budget, consider using a tool like our budget planner).

Currently paying rent? If you’re planning to live in your new home, then this cost will disappear from your budget and be replaced with your home loan repayments. To see how much your loan repayments might be (compared to your current rent), you could play around with our home loan repayments calculator.

Don’t forget, some of the money you’re currently squirrelling away for your deposit could go towards home loan repayments when you buy the house, too.

Factor in fluctuations

Things can change … both within your own life and the world around you.

For example, variable home loan rates can fluctuate. Even though this is all a bit beyond your control, you can put yourself in the driver’s seat by making sure that you could handle interest rate increases on your home loan.

Then there are the things that change in your own life. Planning a family soon? Kids can cost money. Or have you been thinking about returning to study, and working less while you learn? What about a new business venture? Such pursuits can significantly affect your income and expenses – and hence your ability to comfortably pay back a home loan.

Given all these variables, you should think long-term when you’re working out how much you can borrow.

Talk to the experts

Once you have a rough idea of how much you can borrow, it’s time to validate your theories by talking to some lenders. Only by running through your personal situation in a little more detail will you get an accurate picture of the price tags you can afford.

ING home loan specialists are here to help. If you’ve got a deposit ready, we can sort out pre-approval for you – so you can house-hunt with more confidence that you’ll get the loan you’re after. Or, if you’re still in the early stages of saving up a deposit, we can assess your financial situation and give you a clearer indication of how much you might be able to borrow.

Loan Repayments Calculator

The Loan Repayments Calculator is not an offer of credit and is an approximate guide only. It gives an indication of the type of repayment required and the total interest payable, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate.

The formulae used may change at any time without notice. The calculators are provided by InfoChoice.

Borrowing Power Calculator – ING

The ING Borrowing Power Calculator is not an offer of credit and is an indication only based on the stated assumptions and the information entered by the customer.

The information is current as at publication. Any advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. Deposit products, savings products, credit card and home loan products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292, AFSL and Australian Credit Licence 229823. All applications for credit are subject to ING’s credit approval criteria, and fees and charges apply. You should consider the relevant Product Disclosure Statement, Terms and Conditions, Fees and Limits Schedule, Financial Services Guide, Key Facts Sheet and Credit Guide available at ing.com.au when deciding whether to acquire, or to continue to hold, a product. Before interacting with us via our social media platforms, please take a minute to familiarise yourself with our Social Media User Terms https://www.ing.com.au/pdf/Social_Media_User_Terms.pdf.